Recession alarm bells are ringing…again.

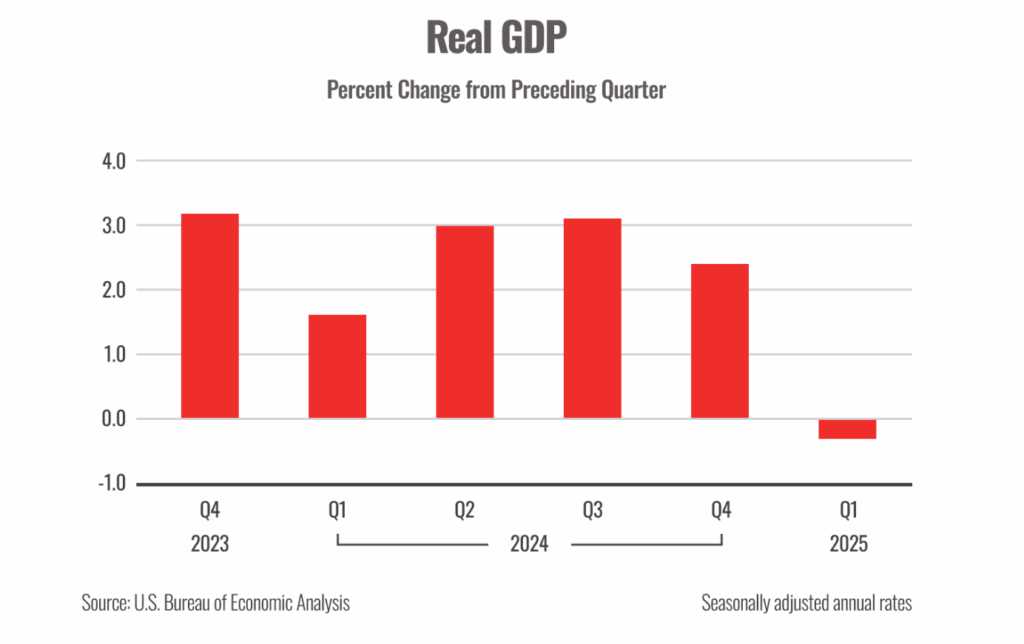

The latest GDP report shows the economy shrank by 0.3%.1 That kicked off a flood of doomscrolling, scary headlines, and panicked selling.

But before we jump to conclusions, I want to discuss what’s really behind the number. Upon close examination, it is one of the more interesting GDP reports in recent memory.

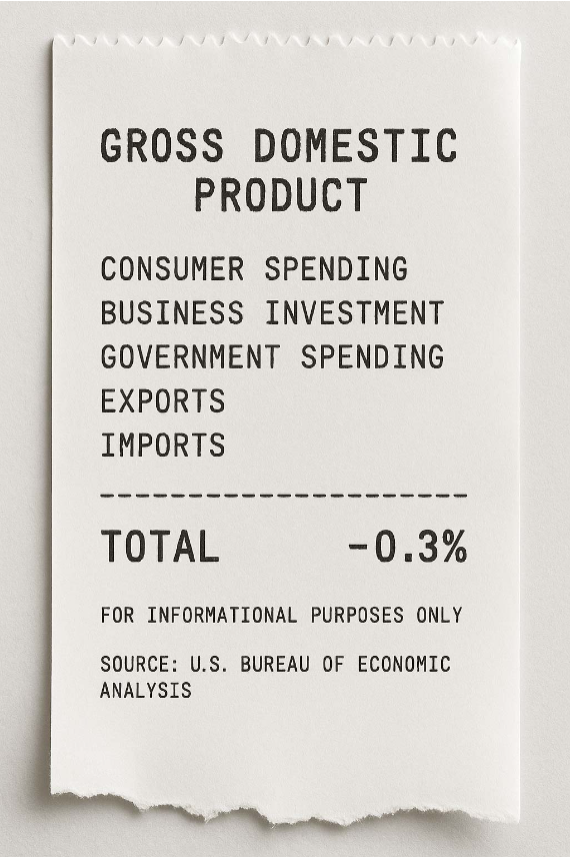

As a quick refresher, think of GDP like a grocery receipt for the entire country.

It adds up everything we produce domestically… goods, services rendered, Government spending, etc. When that number is smaller than previous quarters, it often signals a problem for a country’s economy.

But sometimes, the final tally can be a little bit misleading. That why I wanted to provide some context on the details of this particular report.

The first number that stands out in last week’s report? Business investment. Corporate spending on equipment increased 22% during the first quarter.2 That number is quite a bit higher analysts expected. This is notable because that’s not something we usually see right before a recession.

We also saw a 1.8% bump in consumer spending.3 While that figure wasn’t as robust as we have seen in previous quarters, Americans usually shut their wallets ahead of a downturn. Our economy is driven in large part by consumer spending, so this figure represents a degree of confidence in the U.S. economy and would seem to indicate that Americans are still willing to spend.

So what was the major cause of the big drop in GDP? A 41% spike in imports.4

With the threat of tariffs tied to President Trump’s proposed trade changes looming, companies raced to stock up on goods. Particularly goods that are sourced from abroad.

Why does that matter?

Because in the GDP equation, imports don’t just get ignored. They’re actually subtracted from other economic activity.

That means even with solid economic activity overall, those extra imports pulled the final number down.

Think of it like this… If GDP is like a grocery receipt, it only counts what we grow or make ourselves. Anything that is imported from another country is subtracted from the overall productivity of America.

So if you fill your cart with imported bananas, the house is still full of food. But the total on the receipt drops, because we don’t grow those bananas here in America.

That’s what happened last quarter. While exports grew modestly, imports ballooned, thus leading to the lower GDP number overall.

So, what does this all mean?

First, the economy still has signs of strength.

People are still spending. Companies are still investing. The labor market is still strong.

We are not in a recession. At least not yet.

Second, we’re not out of the woods. President Trump didn’t announce his tariff plan until midway through the quarter. So the real effects of these new policies might not show up until after Q2.

And there’s good reason to be worried. A number of leading indicators, such as consumer confidence and at times, the stock market, have started flashing red.

Of course, no one knows what’s coming next. But if we are heading towards a recession, what can you do now to prepare?

Here are three simple ways to shore up your finances:

Top off your emergency fund. Having 3 to 6 months of expenses saved gives you breathing room if things slow down economically.

Pay down high-interest debt. This frees up more cash flow and lowers your financial stress.

Check your spending habits. If we do end up in a recession, we may want to see where we can decrease our spending in certain non-essential areas.

Here’s one more thing to remember. While the headlines may change, your long-term goals shouldn’t. Your financial plan should be designed to hold steady through ups and downs. That’s the power of planning ahead.

Want to talk through how this news fits into your strategy? Let’s schedule a quick time to connect.

Sources:

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.